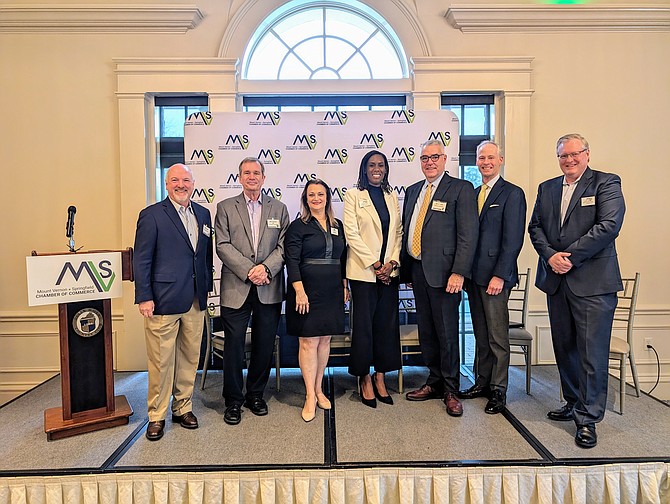

The Mount Vernon Springfield Chamber Economic Outlook event. From left: Terry L. Clower, Northern Virginia Chair and professor of public policy in the Schar School of Policy and Government at George Mason University; Mike Kitchen of Christopher Consultants, now IMEG; Rachel Carter, Coldwell Banker Realty, District Manager Northern Virginia and Branch Vice President; Roberta Tinch, President & CEO, Inova Mount Vernon Hospital; David Boyle, President & CEO, Burke & Herbert Bank; ack Perkins, Vice President, Elm Street Development; Eric Christensen, General Manager, Springfield Town Center

This past Thursday, April 11, business professionals across Fairfax County gathered for the annual Economic Outlook event. The event, presented by Walsh, Colucci, Lubeley, and Walsh PC., is produced by The Mount Vernon Springfield Chamber of Commerce in partnership with Southeast Fairfax Development Corporation and features experts from critical industries who discuss the significant developments of 2023 and provide insights into the economic course for the current year.

Eric Christensen, Chairman of the Chamber and General Manager of Springfield Town Center, opened the event by welcoming the local politicians in attendance, Supervisor Dan Storck, Sen. Scott Surovell, and Del. Mark Sickles, followed by recognizing the sponsors.

Terry L. Clower, Ph.D., Northern Virginia Chair and professor of public policy in the Schar School of Policy and Government at George Mason University, discussed recent economic performance and outlook compared to national numbers.

“Throw away all your old college economics textbooks,” said Clower, “because nothing we are seeing now is how we would expect the economy to function.”

According to Clower, rising interest rates should equal slowing job growth. However, that’s not what we witnessed in the first quarter of 2024, where job numbers exceeded expectations. Despite some job growth, our local economy is still trailing behind the national average. This is in part due to rising insurance costs, the cost of housing, and the cost of automobiles, he said.

“While an interest rate of 6% isn’t bad, it’s not as good as the 2.75% we once had,” said Clower.

The Northern Virginia job sectors that saw growth over the past year include education and health services, state and government, leisure and hospitality, construction, and manufacturing. Retail, as well as business and professional services, saw a decline. Clower pointed out that the area is falling behind the national average in job growth. One of the issues stems from relocation, where potential employees are not willing to move to Northern Virginia, where the cost of living, including housing and childcare, is high compared to other metro areas around the nation. Before leaving the stage, Clower spoke of the importance of data storage facilities due to AI and how the high demand can lead to rapid job growth, something every state is racing to attract.

With that, the panelists were introduced:

* David Boyle, President & CEO, Burke & Herbert Bank

* Rachel Carter, Coldwell Banker Realty, District Manager Northern Virginia and Branch Vice President

* Eric Christensen, General Manager, Springfield Town Center

* Jack Perkins, Vice President, Elm Street Development

* Roberta Tinch, President & CEO, Inova Mount Vernon Hospital

Mike Kitchen of Christopher Consultants, now IMEG, asked the panelists questions related to the housing industry and interest rates, new housing development, office vacancies, retail, and healthcare.

David Boyle, President & CEO of Burke & Herbert Bank, cited higher interest rates that will be with us for a while as an issue. “When the Fed does cut rates, we’re not going back to where we were five years ago,” he said. “However, we will still trend down.” The commercial real estate sector is also struggling as people continue with remote and hybrid work. Despite this, Boyle mentioned how banks like Burke & Herbert are in a good position in terms of credit posturing and underwriting, making the difficulties easier for businesses to manage.

Rachel Carter, Coldwell Banker Realty, echoed Boyle, saying 5%-6% interest rates are here to stay. However, buyers are comfortable with that rate, she said. A big concern in real estate over the past several years is the lack of inventory, which affects the resale market. Carter stated that those waiting for the interest rates to drop before buying should go ahead and buy, as rates will not move much. Buyers and sellers should also note that, “Inflation will continue to be a problem. … Bathroom and home remodeling are 30% higher than a few years ago, but that’s a challenge we can prepare for.”

Jack Perkins, Elm Street Development Vice President spoke on new home construction. While builders have seen record sales lately, land development continues to be costly and unpredictable and can constrain supply. This makes it a challenge to increase the housing supply to meet demand. Interest rates are especially challenging for new construction as multi-family projects are interest rate sensitive. Despite the rise in rates that started in 2022, Perkins referenced Fairfax County’s Economic Incentive Program as very helpful for getting projects going. Created in 2020, the “EIP provides an economic incentive to the private sector to purchase, assemble, revitalize and redevelop property for economic development purposes through financial and regulatory incentives.”

Roberta Tinch, President & CEO of Inova Mount Vernon Hospital, said the healthcare workforce and supply chain have fluctuated over the past few years since the pandemic. However, the industry has adapted well to the change, adjusting as needed. As Clower had mentioned, the health services sector has seen steady growth in jobs. Tinch reflected on this, saying the industry has been able to attract new talent with higher wages and more incentives.

“We are working to better incorporate A.I. and virtual nursing — ways to bring technology to the bedside to supplement and help support the nurses so we don’t have to double the number of people.”

For the retail industry, Eric Christensen, General Manager of Springfield Town Center, said he and others were hesitant about the sector following the pandemic. However, it has bounced back, specifically at Springfield Town Center, with a wave of new entrepreneurs and stores. The restaurant row and Lego Discovery Center have especially been very successful and create a lot of traffic.

Throughout their answers, all panelists emphasized how more affordable housing would help the area in many ways, including attracting new talent and ensuring the money employees receive is circulated back into the community.

The program concluded with a Q&A session with the panelists, during which attendees could ask questions and learn more about the challenges and opportunities facing businesses in 2024.

The event sponsors were Walsh, Colucci, Lubeley, and Walsh PC., ECS Mid-Atlantic LLC, Fairfax County Economic Development Authority, IMEG Consultants Corp., Sam Media Productions, Bean, Kinney & Korman PC, Jennifer Molden, Realtor at Coldwell Banker, Elm Street Communities, Fairfax County Department of Economic Initiatives, and the Seward Group. The program sponsor was Hoodwinked in London, a fast-paced thriller written by former Chamber Board member Gavin Carter under the pen name James Oldham.

Photos, slides, and videos from the event can be seen at wwww.mountvernonspringfield.com/economic-outlook/.