Expenditures for the Alexandria Fire Department are expected to grow about 8 percent largely based on unionization of its workforce. The Department of Transportation and Environmental Services is setting aside $60,000 to replace street signs currently celebrating Confederate military officials. And half a million dollars has been set aside in contingent reserves for City Council members to load up the budget with their proposals ahead of the May 3 deadline. But none of those things are likely the first question that will be asked about the budget proposal for fiscal year 2024. The city is taking on debt to fix its antiquated sewer system, solve persistent flooding issues, build new schools and redevelop Potomac Yard and Landmark.

The city is taking on debt to fix its antiquated sewer system, solve persistent flooding issues, build new schools and redevelop Potomac Yard and Landmark.

The city is taking on debt to fix its antiquated sewer system, solve persistent flooding issues, build new schools and redevelop Potomac Yard and Landmark.

The city is taking on debt to fix its antiquated sewer system, solve persistent flooding issues, build new schools and redevelop Potomac Yard and Landmark.

"If everybody is being truthful, you'll get the same answer from everyone," said former City Councilman David Speck, who will be appearing on an Agenda Alexandria panel about the city budget next week. "What is the proposed tax rate?"

The city's tax rate may be the only thing not in transition. The proposal is to keep it at $1.110 for every $100 of assessed value, which is the highest tax rate in the region. Because properties in the city continue to rise in value, that means the average residential tax bill is expected to increase by about $450. That's about 7 percent higher than last year's bill. City Council members could choose to squeeze about $200 million out of property owners if they end up going with the rate they voted to advertise earlier this month, which is $1.115 for every $100 of assessed value.

"The rate that property taxes are increasing is unsustainable," said former City Councilman Frank Fannon, who will also be a panelist at the March 27 panel discussion. "The biggest threat to affordable housing in Alexandria is the constant increase of property taxes."

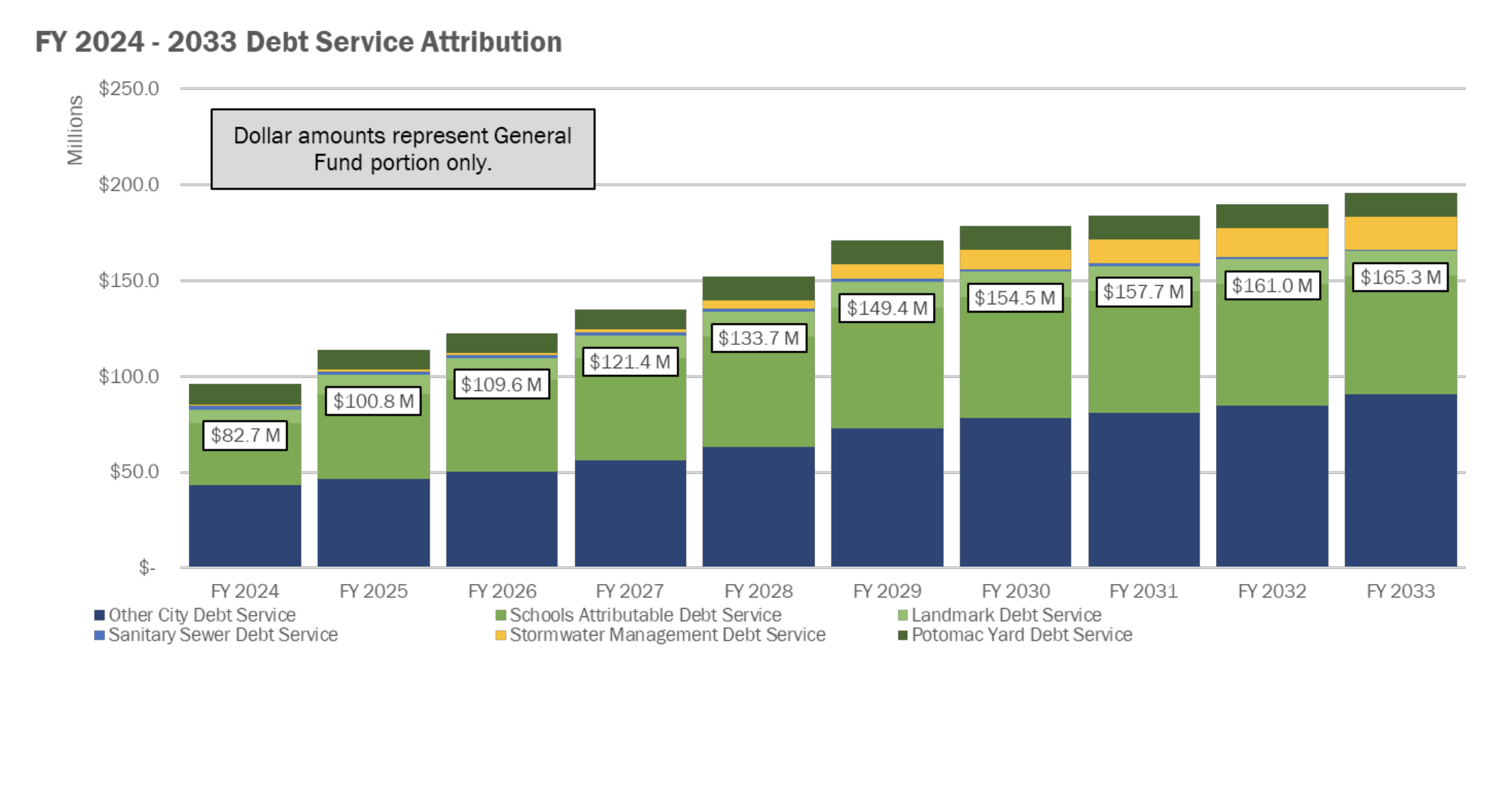

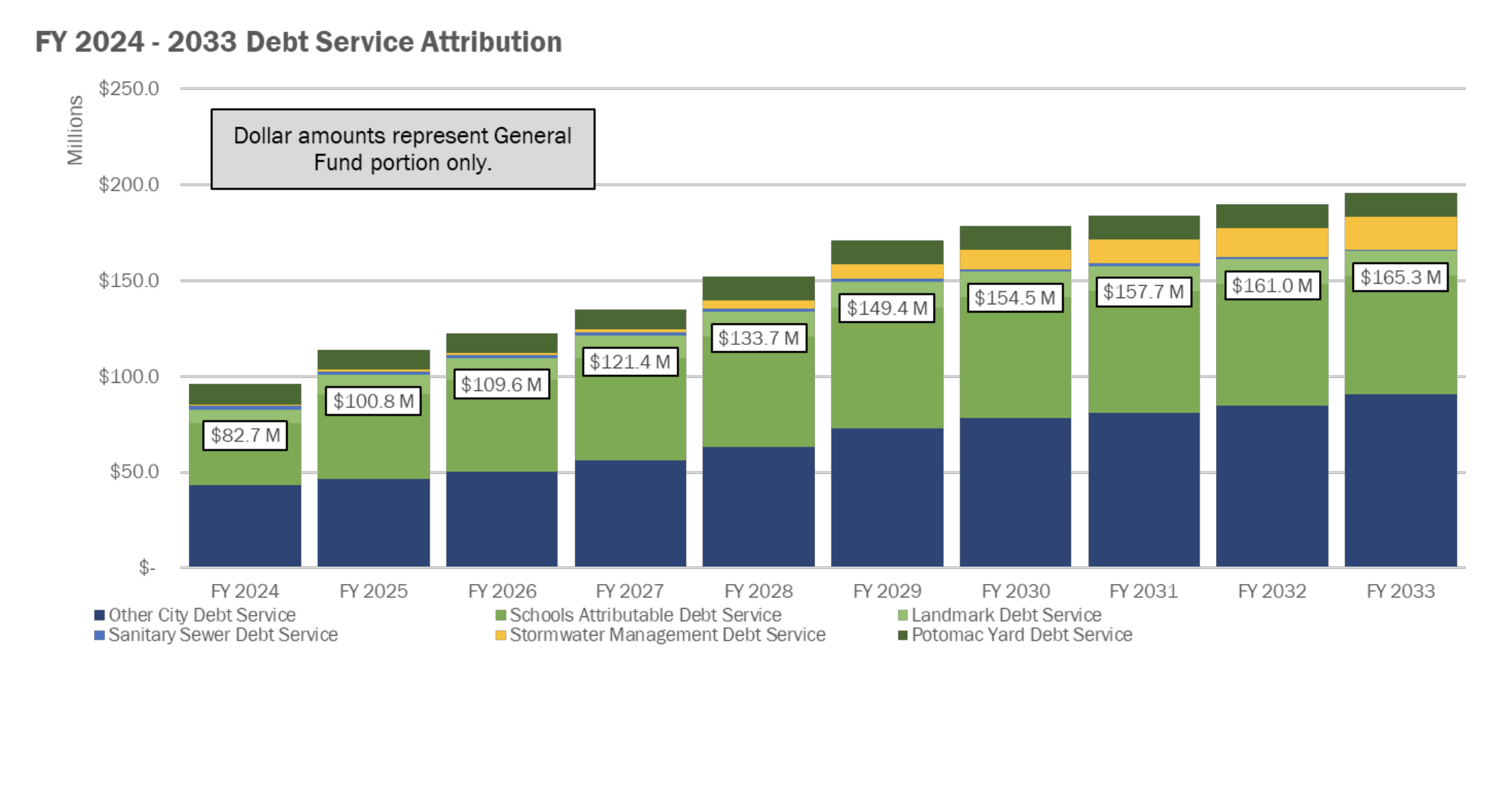

AS THE CITY GROWS, it's also taking on debt — especially the school system. The debt service for Alexandria City Public Schools is expected to grow almost 40 percent, driven by major projects at Douglas MacArthur Elementary School, George Mason Elementary School and the high school campus project. The city's debt service is expected to grow about 6 percent this year, driven partly by fixing the city's antiquated sewer system but also by redevelopment at Potomac Yard and Landmark.

"We are not a mature city at this point, and we are still going through tremendous growth," said Alexandria resident Alan Shark, a professor at the Schar School of Policy and Government at George Mason University. "People are investing billions, so the amount that the city is proposing by way of debt is relatively small compared to the investments made in the private sector."

One limitation that City Council members have to deal with is a revenue stream that's heavily reliant on property taxes, which make up more than 75 percent of revenues for the city. Alexandria also receives some money from the federal government and the state government plus a steady stream of money from the meals tax, the admittance tax and the sales tax. One potential way to get new sources of revenue would be for the General Assembly to pass a new law allowing Alexandria to have an income tax.

"We are a wealthy community," said Speck. "And we don't capture that wealth with income-driven revenue."

WHEN HE PRESENTED his budget to City Council members late last month, Parajon emphasized that one of his goals in crafting the proposal was that viewed priorities through a lens of race and social equity. Part of that effort was an appendix titled "budget equity tool," which highlights a reduction of financial assistance to eligible residents through the Northern Virginia Dental Clinic. Perhaps the one that has grabbed the most attention is the $60,000 to rename streets currently honoring Confederate insurrectionists who took up arms against the United States of America.

"This is going to be a major inconvenience to every homeowner," said Fannon. "The only people who seem to be hung up on the Civil War these days are the current City Council."